Avoiding Supply Chain Breakdown

This article presents a comprehensive practice oriented framework for managing supply chain disruptions by Sunil Chopra and ManMohan S. Sodhi. The article has been published in the MIT Sloan Management Review in 2004. The framework covers everything from risk analysis to the selection of the risk mitigation strategy.

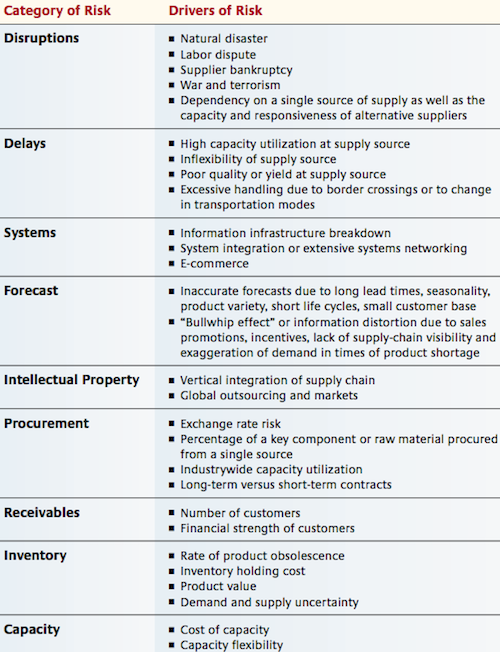

Risk Categories

Chopra and Sodhi find nine categories for risk in the supply chain context. In figure 1 they contrast the risks with the corresponding risk drivers.

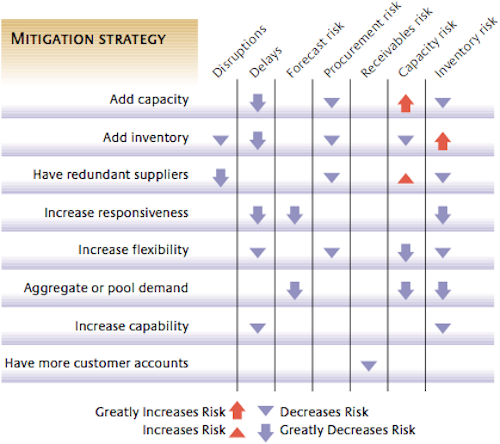

Risk mitigation

The above mentioned risks have to be analyzed and if necessary mitigated. Risk mitigation as a process of managerial decision making can be quite cumbersome, since there is no catch-all strategy and some strategies can even increase other risks as a side effect. Figure 2 highlights the effect of selected mitigation strategies on the risk categories.

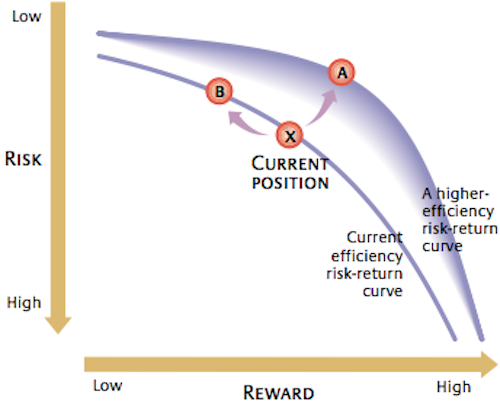

Cost of risk mitigation

Very often risk mitigation not only comprises a laborious decision process, but also the resulting strategy implementation can mean a huge financial expenditure. Some strategies on the other hand are not only capable of reducing risks but can also increase profitability. Figure 3 highlights the dilemma. The goal should be to jump from the current position “X” to a higher risk-return curve (eg. “A”), instead of moving within the existing decision space.

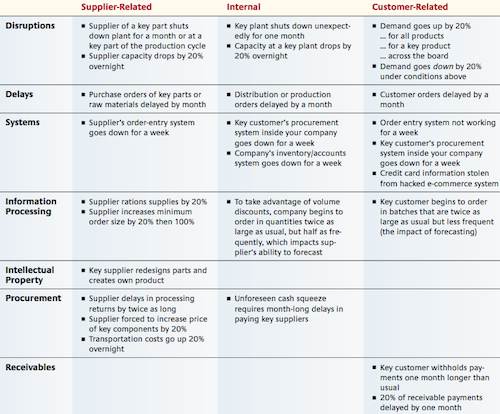

What-if analysis

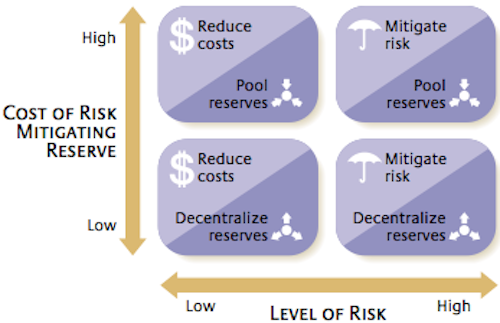

The authors suggest to use a what-if scenario analysis to assess a companies / supply chains propensity towards certain risks. In the matrix displayed in figure 4 the risk categories are further separated into supplier-related, internal and customer-related parts.

Risk and reward

To balance risk versus reward the authors recall three essential relationships:

- The cost of risk reduction increase with the level of risk (the higher the risk the higher the cost to mitigate)

- Risk pooling reduces the cost to mitigate risks (eg. pooling demands of several customers reduces the cost to mitigate the risk)

- The pooling effect is more pronounced when the pooled risks are very high

Depending on the level of risk and the cost of a mitigation reserve the authors suggest four generic strategic approaches to how to mitigate risks under different circumstances (figure 5).

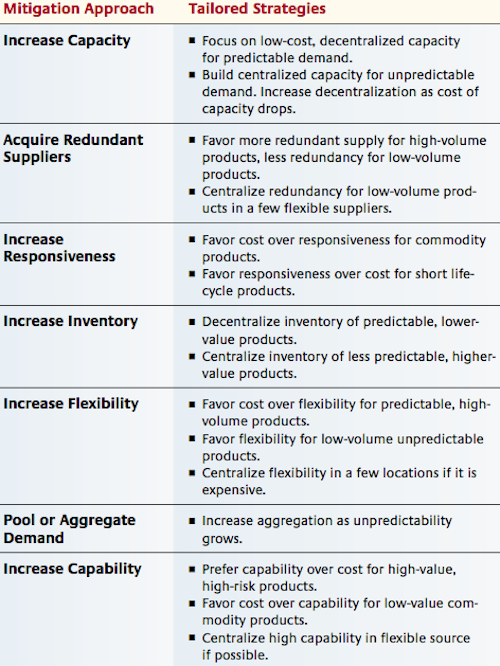

Tailored strategies

Finally the authors show examples of risk mitigation strategies and when to use them. The results are shown in figure 6.

Conclusion

I was surprised by the number of topics the authored covered in a single paper. They really tried to cover the whole risk mitigation process, and they succeeded.

Of course, most of the presented results are not really new and not covered in depth, but they make a excellent basis for strategic, business oriented discussions on supply chain risk management.

One drawback though: I did not really understand why exactly those risk categories (figure 1) were chosen. From my point of view the those are not very intuitive since the categories are not exclusive and thus overlap (eg. a disruption can also lead to a delay. Or why is a information infrastructure breakdown a systems risk and not a disruption?). This makes it harder to use the risk categories efficiently. But the categories could easily be replaced by another framework (eg. by Christopher and Peck, 2004)

Chopra, S., & Sodhi, M.S. (2004). Managing Risk To Avoid Supply-Chain Breakdown MIT Sloan Management Review, 46 (1), 53-61

Comments

For research purposes!

Add new comment