Impact of Risks on Supply Chain Performance

I am often astounded by the fact how many great articles I haven’t read yet. A good scientific paper contains an comprehensive description of the methodologies used, a theoretical foundation and literature review from which hypothesis are drawn, which are then confirmed or rejected in the course of the paper. And of course, it is always a plus to actually find some results in the course of the analysis.

From this category I would like to introduce an article by Wagner and Bode (2008) on an empirical examination of supply chain performance along several dimensions of risk. The complete article is defnitly worth a read and can be found here (free of charge).

Introduction & Hypothesis

The authors start by highlighting the major factors involved in the importance of supply chain risk management nowadays: There has been an upward trend in crisis and catastrophes, at least on the level of media coverage and awareness. Furthermore modern supply chains have been optimized for leanness in recent years, leaving them more exposed towards risks.

To decide on the the possible investments on mitigation strategies, a supply chain manager needs to know the probability of an adverse event and the effect of the disruption on supply chain performance.

Hendricks and Singhal (reviewed here 1, 2) already concluded, that SC risks can have severe consequences on performance and the stock price.The goal of this article was to establish a more direct link between what risks affect the performance most. The authors build their hypothesis building on contingency and strategic choice theory, arguing that the environment is a major determinant of business performance, nonetheless managers still can make “strategic choices” to improve performance. Of course this sounds like common knowledge, and it is, but it is essential from a scientific point of view to root his own ideas in a foundational theory.

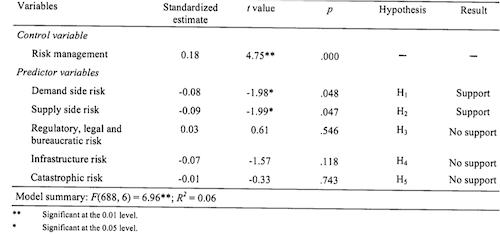

Using a literature review the authors decide on the following risks to include into their research: (1) demand side; (2) supply side; (3) regulatory, legal and bureaucratic; (4) infrastructure; and (5) catastrophic.

From these risks five hypothesis emerge, following this structure:

H1: The higher the demand side risk, the lower the supply chain performance. …

Methods

In contrast to Hendricks and Singhal, who analyzed the impact on the level of stock prices and public company performance data, Wagner and Bode conducted a survey with a final sample size of 790 supply chain professionals from companies located in Germany. Non-response bias has not been found. The questionnaire has been carefully designed, for each hypothesis multiple measures were included. E.g. demand side risk measures consisted of two items that capture the risk deriving from the interaction (or lack thereof) with customers and volatility of the market. The results were analyzed using correlation analysis and reliability evaluations

Results

The results show that in the view of the experts demand and supply risks have an impact on supply chain performance, whereas there is no significant relationship between regulatory, infrastructure and catastrophic risks and supply chain performance.

On first sight these results stand in contrast to the results of Hendricks and Singhal, where a huge impact of any disruption on performance has been encountered. This can be explained by the different focus of the analysis, where Wagner and Bode took a sample from all companies, which naturally only seldom experience severe disruptions whereas Hendricks and Singhal especially picked the larger (and worthy of a public announcement) disruptions. So a catastrophic event still has a negative impact on the sample group, but since the probability is so low it does not pose a significant impact on performance.

The managerial implications therefore are:

- Importance of a supply chain risk management framework

- Scarce resource should be deployed to mitigate the “every day” risks from supply and demand

Conclusion

This article also concludes as a text book example of “how to write a scientific paper”, it finishes with recommendations for the implementation of the results and further research gaps and still leaves something to say for critics like me:

It is very interesting to see the findings by Hendricks and Singhal in a new light, from the point of view of a supply chain professional.

But this study also points the perception of risks (have a look Part 1 and Part 2) as a major driving factor in these results.

Wagner and Bode also discuss the factual risk situation in the sample companies (all from Germany), which probably skews the results. All the risks mentioned might be (perceived or real) quite different in other countries.

Wagner, S.M., & Bode, C. (2008). An empirical Examination of Supply Chain Performance along Several Dimensions of Risk Journal of Business Logistics, 29 (1), 307-325

Add new comment