Managing Disruption Risks using Real Options (SCRM Thesis)

This is the seventh contribution to my series on doctoral and master dissertations on Supply Chain Risk Management. This again is a master thesis from the MIT. An immense effort and dedication is spent on these works only to find the results hidden in the libraries. So the goal is raise interest in the research of my peers.

Author / Topic

This thesis was written by Sophie Pochard already in 2003 as her master thesis at the Massachusetts Institute of Technology, Cambridge, USA. It can be downloaded here directly at the MITs web site. It has been supervised by Richard de Neufville, Professor of Engineering Systems and Civil and Environmental Engineering. The title is: Managing Risks of Supply-Chain Disruptions: Dual Sourcing as a Real Option.

Summary

In her thesis Pochard focussed on multi-sourcing as sole risk mitigation strategy. But first the author elaborates on how resilience in a company can be achieved and more interestingly some limitations to resilience with a focus on dual sourcing, which are:

- Complexitiy, increasing resilience often also increases the complexity of the supply chain (eg. dual sourcing).

- Risk trade offs, having only a single supplier can also reduce risks (eg. protection of intellectual properties).

- Cost issues, resilience often increases cost.

To analyze multiple sourcing strategies Pochard then introduces real options, where the definition is similar to that of a financial option contract:

Call options give to their holder the right to undertake an investment, at a cost that is fixed in advance (the exercise price), at or before a given date (the maturity). For example keeping unexploited leases can be assimilated to a call option. Oil companies do not sell or exploit these leases as they want to keep the right to develop them later on; they may, for example, decide to use this right if ever new drilling and production technologies allow to increase recoverable reserve. This is a call option since the exploitation makes it possible to get the income of the underlying. Its exercise price is the investment cost to initiate the production, and the maturity is simply the date until which firms have the authorization to exploit.

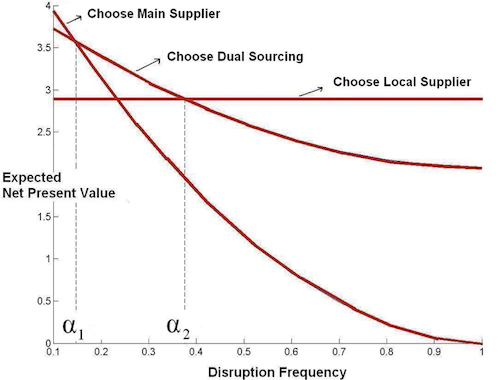

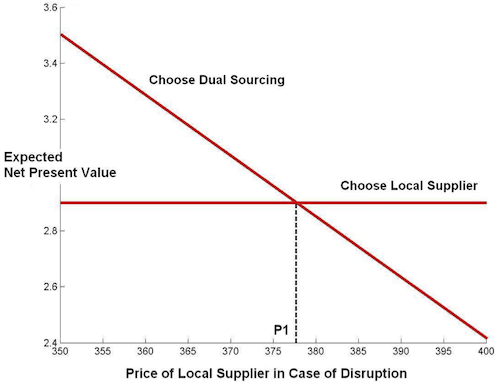

So as the next step dual sourcing is modeled as a real option. And the author presents her results in several diagrams where I show three here in the blog (figures 1 and 2).

Both independent variables (disruption frequency and cost of local supplier in case of disruption) seem to have a major impact towards the selected strategy. Pochard concludes that the real options can be a valid method to analyze the benefits of different strategies.

Conclusion

I think that her thesis can be used as a basis for a variety of topics. She writes about disruption risks, resilience and risk mitigation strategies, of course the definition of real options and how to develop and deploy a corresponding model.

I also think that this variety is also the major weakness of this work. Compared to my last MIT master thesis (Impact of demographics on supply chain risk management practices) Pochard takes a very long time to get to the real topic and browses a long time through other connected fields.

Nonetheless the results are very interesting and seem to be comparable to other (later) papers.

Pochard, S. (2003). Managing Risks of Supply-Chain Disruptions: Dual Sourcing as a Real Option Massachusetts Institute of Technology, Master Thesis

Add new comment