Modeling uncertain forecast accuracy in supply chains with postponement

LeBlanc, Hill and Harder emphasis the uncertainty in forecast accuracy in their 2009 paper. And therefore address a huge gap in current SCRM research.

Model

In the model of LeBlanc et al. exist two uncertainties: Uncertainty over forecast accuracy and demand uncertainty.

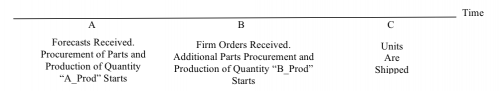

There are two decision points where the manager can decide if / how much he wants to produce: A and B. At time C the finished goods are shipped. Restrictions to the production quantity at A an B can be applied.

LeBlanc et al. address three questions with this model.

- How much should the firm pay to improve the accuracy of the forecast?

- How much should the firm pay to achieve strategic changes, such as reducing the cost of incurring each shortage or the cost of delaying procurement and production until time B?

- For different forecast accuracies, shortage and holding costs, postponement add-on percentages, etc., what percentage of the forecast should a manufacturer postpone until time B, instead of producing at time A?

Solution

The solution is done in using dynamic programming. The random variables have overlapping sums, the Forecast is calculated by FC = X_1 + X_2; the actual demand is calculated by AD = X_2 + X_3.

Using this technique it is easy to simulate different forecast accuracies: If X_2 is low compared to X_1 and X_3, forecast accuracy is low as well, and vice-versa.

Result

After implementing this model in a computer, it is possible to answer the above mentioned questions, and especially quantify the benefit of better forecasting accuracy.

LeBlanc, L. J., Hill, J. A., & Harder, J. (2009). Modeling uncertain Forecast Accuracy in Supply Chains with Postponement Journal of Business Logistics, 30 (1), 19-31

Add new comment