Risk, Information and Incentives in Telecom Supply Chains

Supply chains risks can also be analyzed in a specific industry context and this is exactly what Agrell et al. (2004) did with telecom supply chains. They used a three tier SC (2nd tier supplier, EMS, OEM) to include the selection, coordination and motivation of independently operating suppliers in the model.

In terms of risk handling and sharing the telco industry is to some extent unique as well; there are several possible complications, like

- differing business logic in the different stages,

- individual relations between revenue and product life cycles

- design of products and processes and

- a lack of effective incentive structure to induce global supply chain optimization promotes the opportunistic and myopic behavior of the chain firms.

Telco Industry

The telco industry can be described using the following dimensions.

- Demand uncertainty

- Level

- Timing

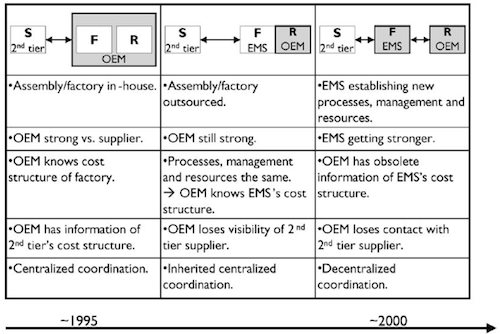

- Changing Roles

- Outsourcing

- Unclear Interfaces

- Growth vs. Consolidation

- Shifting power balance due to consolidation at supplier level

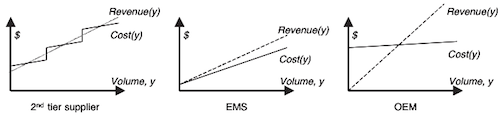

- Heterogeneous Business Logic (see Figure 2)

- The cost and revenue functions are different

Model

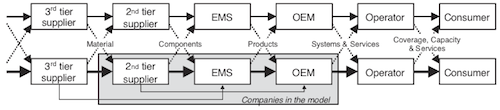

The authors developed a three stage model with the 2nd tier supplier (for components), the EMS (Electronics Manufacturing Services Provider) and the OEM (Original Equipment Manufactur) in focus (gray box in Figure 3).

The experiments with the model take place using a two period time horizon. The OEM tries to maximize the profit over this period.

Knowledge about the system is explicitly divided between the participants: Common knowledge: current demand, Supplier: its cost function and investment opportunities.

Information can be shared: The OEM can send a forecast to its suppliers and it sends order quantities for the first and second period to its suppliers.

The following alternative scenarios are then compared:

- Centralized model

- OEM coordinates with asymmetric information

- Coordination by EMS

Results

The differences between the scenarios are quite low, nonetheless the following conclusions can be drawn:

The performance of the supply chain as a whole may be undermined by the shifting positions of bargaining strength (towards the suppliers).

And the model shows furthermore that simple price-quantity-only coordination (without long-term contracts) as some shortcomings which leads to reduced performance as well.

Conclusion

One question the article did not answer: Why specialize on the Telco industry? The above mentioned description of the industry might fit on others as well, so it would have been more straight forward to develop the model based on the abstract scenario description and use the telco industry as a case study.

Contrary to the description, the model is basically a four-tier model. Since also the customer of the OEM is taken into account as the final source of demand.

But in my view what stands out is not the number of tiers in the model, but the very explicit modeling of the knowledge distribution. Many papers only take a very brief detour on the knowledge that each participant has, or leave it out entirely. But not only for the quality of the model, but also its reproducibility it is important to take the information distribution into account.

Agrell, P., Lindroth, R., & Norrman, A. (2004). Risk, information and incentives in telecom supply chains International Journal of Production Economics, 90 (1), 1-16 DOI: 10.1016/S0925-5273(02)00471-1

Add new comment