Single or Dual Sourcing

Today there is only one simple question: Single or dual sourcing, what strategy should be used when faced with disruption risks.

Definitions

There are four different approaches to sourcing sole, single, dual and multiple sourcing. Sole sourcing refers to a scenario where there is only one supplier in the supplier base, whereas single sourcing refers to the conscious decision to select one, single supplier out of a choice of suppliers. The dual sourcing model indicates that two suppliers are used (not necessarily at a comparable share). As the name says with multiple sourcing, multiple suppliers are selected, depending on the price or another criteria. The paper presented here focusses on single and dual sourcing only.

Model

The authors (Yu, Zeng and Zhao) make use of a mathematical model which contains a two echelon supply chain with two suppliers. One of the suppliers (main supplier) is located offshore (long lead times) and prone to disruptions, but on the other hand less expensive. The second supplier is located locally, but more expensive. Therefore there are three different sourcing alternatives: single sourcing of the main or the secondary supplier or alternatively dual sourcing with both suppliers.

Demand in the model is correlated with the price and stochastic.

Results

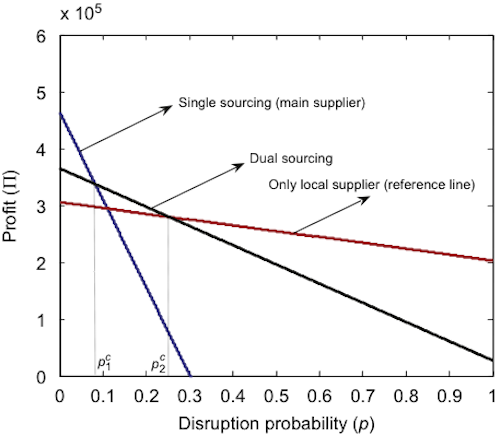

For each of the sourcing strategies the authors prepare and compare the profit equations. As a result the authors conclude that there are two critical disruption probabilities at the main supplier: p1c and p2c (p1c2c) which build a frame for three different cases:

- Case 1: the disruption probability of the main supplier is less than p1c then it is optimal to only source from the offshore main supplier.

- Case 2: p1cdisruption 2c, then it is optimal to source from both sources

- Case 3: the disruption probability is larger than p2c, then it is optimal only to source from the reliable, local supplier.

Figure 1 shows the three cases.

Conclusion

Of course the formulas in the model could be used to calculate the above mentioned probabilities and then compare them to the current disruption probability to decide on the optimal strategy. But this would probably lead to wrong results, since the model contains many assumptions that are probably not met in your case study. But the intension of the model is clear: To highlight that depending on the probability of a disruption it, not only can be optimal to have dual sourcing but also to completely switch to a more reliable supplier to optimize profits.

Yu, H., Zeng, A., & Zhao, L. (2009). Single or dual sourcing: decision-making in the presence of supply chain disruption risks Omega, 37 (4), 788-800 DOI: 10.1016/j.omega.2008.05.006

Add new comment