The Power of Flexibility for Mitigating Supply Chain Risks

This article sheds light on the question of how much flexibility is necessary to secure the supply chain against disruption risks.

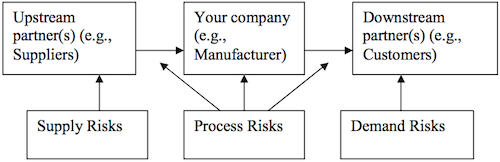

The paper reviewed today takes a closer look at three supply chain risks: supply, process and demand risks (figure 1).

Strategies

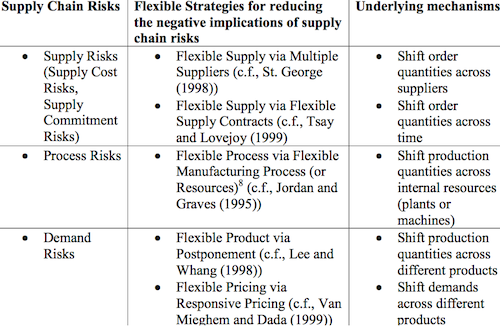

The authors focus on the short term agility to reduce risk and chose five strategies, which are analyzed in depth (figure 2).

The strategies are backed by several case studies each.

For all five strategies the authors build a different model. First stands the description of the scenario, second is the development of the model which fits the scenario and is able to deploy the strategy. The last step is the description of the results.

Supply risks

Flexibility via multiple suppliers

Multiple alternative suppliers can reduce the supply cost risks, since the company gains the flexibility to purchase from the company with the lowest prices.

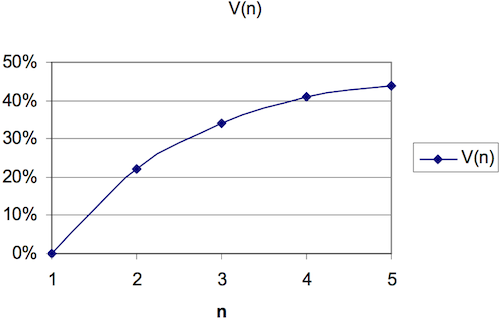

The first model is based on a case by Intercon Japan and Li and Fung. One ordering company is confronted with supply cost risk. The price of the identical goods is random and can vary between $5 and $15. The authors calculate the profit for the single up to a five (optional) supplier case and conclude that profits rise with increasing number of suppliers, whereas the marginal increase declines (figure 3).

Flexibility via a flexible supply contract

Flexible supply contracts allow the ordering firm to adjust its predetermined order at short notice usually within a limited quantity range.

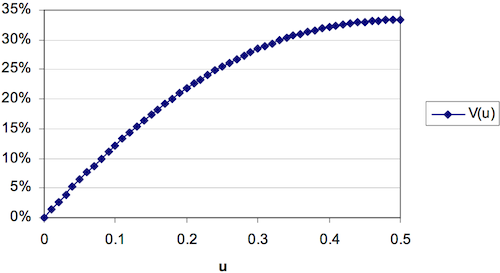

This model is based on a case with Canon, HP and Best Buy. Demand is random, the purchasing contracts between buyer and seller are negotiated in the beginning of a period. But the actual ordered quantity can be adjusted between u% less or more than the originally agreed quantity. Calculating the profits for increasing flexibility u% gives the results shown in figure 4.

Process risks

Flexibility via flexible manufacturing processes

Flexible manufacturing requires a plant to be adaptable to produce a multitude of different products.

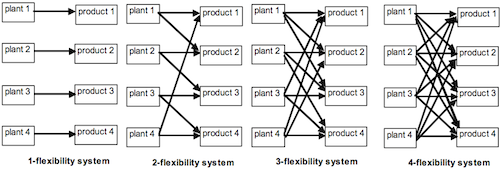

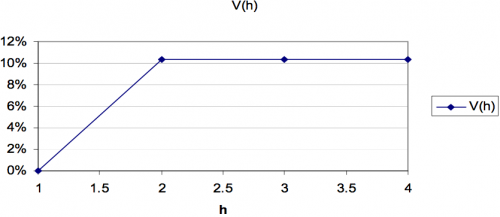

In this model process flexibility is modeled by the number of products (h) which can be produced by one plant. Different forms are shown in figure 5.

The calculations shows that increased process flexibility can also increase profits in an uncertain scenario (figure 6).

Demand risks

Flexibility via postponement

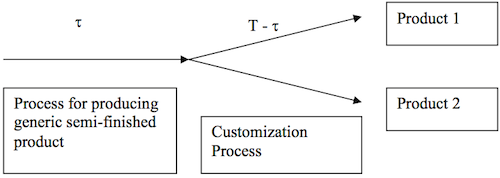

Further flexibility is gained by postponing product differentiation decisions until the latest possible point during the production process.

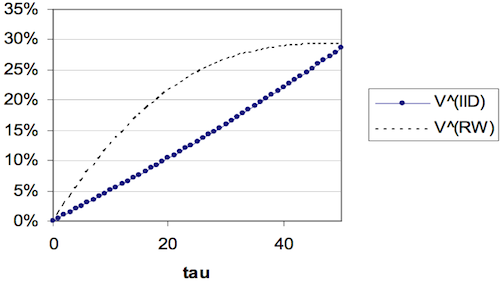

In this model two products are sold at a market, demand for them is uncertain. Postponing product differentiation (shown in figure 7). Calculating profits for two different random processes (Independent and Identically Distributed (IID) and Random Walk (RW) Model), shows that also increase in postponement leads to increasing profits (figure 8).

Flexibility via responsive pricing

Case studies show the value of price adaptability to steer customer demand.

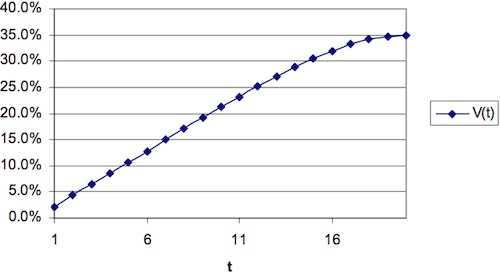

In this model the company is able to postpone the pricing decision for the selling season until the time t. Up to this point in time the company is therefore able to observe demand. Timing flexibility increases as t increases. From this it can also be shown that increasing flexibility leads to better profits with uncertain demand. Figure 9 has the results.

Conclusion

The authors took some effort to generate five different models to analyze the flexibility cases. Nonetheless, I would judge the models to be quite specific for the cases, which is good for the research, but also poses the question: Will these results hold true in any case? For any company and supply chain?

There are other results (e.g. by Tomlin und Wang, 2005, which indicate that flexibility might not be the right choice for risk averse companies, which might be better of by choosing a dedicated strategy instead)

But if you keep this caveat in mind this work is a strong proponent of flexibility as a tool to increase resilience in an uncertain environment.

Tang, C., & Tomlin, B. (2008). The power of flexibility for mitigating supply chain risks International Journal of Production Economics, 116 (1), 12-27 DOI: 10.1016/j.ijpe.2008.07.008

Add new comment