Supply Chains and Finance

This article covers aspects of supply chain and risk management which are related to corporate financing.

All business activities somehow find their way into the balance sheet and profit and loss statement of a company. The current assets (be it material or immaterial) and future profit expectations, lead to a company specific financing volume and a corresponding financing rate/cost. Of course, supply chain management is no exception. The paper I review here (“Supply chain finance: applying finance theory to supply chain management to enhance finance in supply chains”) by Gomm (2010), explains the links between supply chain management and finance and highlights some implications to financing within the supply chain.

Method

The proposed model is based on a review from literature in supply chain and finance.

Several papers already link supply chain with financial side and “studies showed that inefficiencies in the supply chain can waste up to 25% of the operating costs and that leading companies enjoy a 45% supply chain cost advantage over their median competitors.”

Links between SCM and Finance

There are several connection, which link supply chain management and finance.

Potential fields of financial supply chain co-operation include financing mobile and immobile assets within the supply chain, the (shared) financing of working capital in order to leverage the best cost of capital rate within the chain, the optimisation of financial processes using standards and IT systems, cash management in order to optimise the cash-to-cash cycle, and so forth.

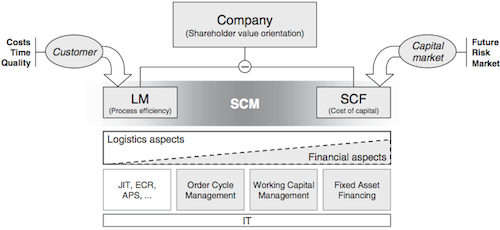

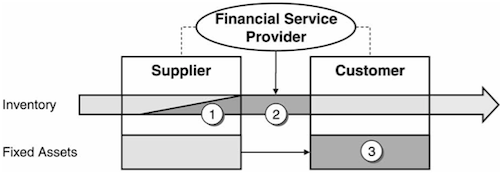

Figure 1 summarizes the transition between logistical and finance aspects in supply chain management.

According to the author the goal should be to use supply chain finance (SCF) to “bridge the customer-oriented demands concerning time, cost, and quality (which are mainly driven by logistics management) with future-, risk-, and market- oriented demands of the providers of capital.”

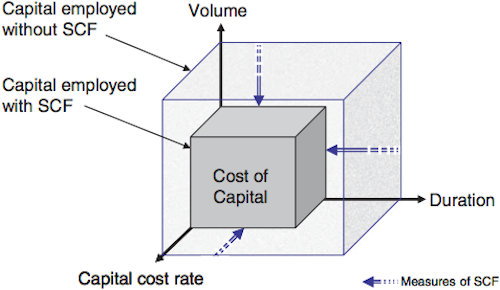

From the literature analysis the levers of SCF are deduced: duration (time), volume (monetary value), in addition (well, multiplication) of the capital cost rate results in the total cost of capital (figure 2).

Creating value

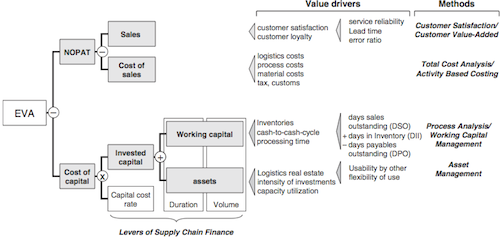

Cost of capital can be reduced internally by working with the mentioned levers. So figure 3 shows different approaches to improve the shareholder value overall from a single company perspective. The NOPAT refers to the “net operating profit after tax”.

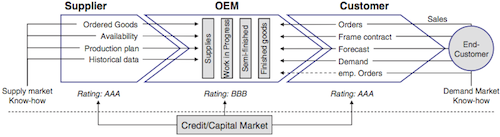

Moreover, value can be created by employing the whole supply chain and its members. Figure 4 shows the example of a four-tier supply chain with supplier, OEM, customer and end-customer and their links on the financial market.

Every company has to finance their activities in some way. In this case, both the supplier and the customer have a higher/better rating on the capital markets than the OEM, implying that their cost of capital should be lower as well. Thus financing the supplied products by either the supplier or the customer should lead to a lower overall cost of capital than if the OEM did all the financing.

Sample strategies

The following three sample strategies build on a given differential in financing cost, it revolves around three financing problems:

- Financing inventories in a make-to-stock supply chain

- Financing inventory in transit

- Financing assets in a production supply chain

Figure 5 exhibits an overview.

I will briefly describe the third strategy here and refer you to the paper for the others. The differential in the cost of capital between the supply chain partners can be used to finance assets within a company:

Instead of buying machines from their suppliers, they [the OEM] leave them as the property of the suppliers and just use them in their production processes. Instead of paying the purchase price of the equipment, they pay per unit that is produced using it. This principle has coined the term ‘pay-on-production’. The benefits for the user of the machines are evident.

Conclusion

A supply chain based reduction of the cost of capital is founded on the fact that the supply chain members can have different financing cost.

The author argues that this is indeed the case; he uses the microchip industry as an example, where manufacturers usually have much higher cost of capital than their customers (e.g. Cisco or Dell).

Supply chain financing strategies therefore might actually help to lower the overall cost of capital in the chain.

Since outside intermediaries, like the financial institutions, do not have all the necessary information (due to principal/agent asymmetries) to provide the same financing offerings. It might be an option to deploy suppliers and customers for financing needs. On the other hand, one should not neglect the additional cost which incur during the searching and negotiations with the potential financing partners (transaction costs) and therefore might significantly lower the potential profits for the lower financing rates.

Gomm, M. L. (2010). Supply chain finance: applying finance theory to supply chain management to enhance finance in supply chains International Journal of Logistics Research and Applications, 13 (2), 133-142 DOI: 10.1080/13675560903555167

Comments

SCF article is very useful for me in the research

Add new comment