Pricing in Times of Disruption

Many articles, including my own research show, that companies tend to focus largely on risk mitigation measures concerning the supply side. Only little is done to include demand side risks or demand side measures into the mitigation of supply chain risks. The study “Pricing During Disruptions: A Cause of the Reverse Bullwhip Effect” focusses on optimal pricing measures during a disruption. And so it helps to close the gap a little bit.

You can download a preprint of today’s paper at SSRN.

Reverse Bullwhip Effect

During a disruptions demand can change quickly. Due to a real or felt shortage customers are likely to order more than they actually need. This effect can be described by the Reverse Bullwhip Effect:

Whenever there is a perceived shortage of supply, it amplifies as it propagates down the supply chain. In fact, forward and reverse bullwhip effects often act as a system. If you start with a sudden upturn in demand, it gets amplified as it goes upstream, which creates a perceived shortage that amplifies as it propagates downstream. This creates a panic and downstream consumers overstate their demand, which amplifies again as it goes upstream. In turn, a greater scarcity is felt, and so on. Each of these effects feeds the other.

Method

The authors establish a mathematical model of a two tier supply chain, containing a single manufacturer (M) and a single (aggregated) demand (C). The process is established as follows:

Before the interaction, the manufacturer is hit by a disruption with a decreasing effect on capacity. The recovery takes place slowly over the course of several periods. The following steps are executed in each period:

- M realizes its current capacity

- M sets a price

- C orders a specific number of products according to its predetermined behavior

The manufacturer has three price setting strategies at its disposal:

- Naive: The price is set only based on the capacity and the long term demand curve of the customer, any short term behavior of the customer is ignored

- One Period Correction: The deviation between the long term demand and the actual order of the customer is taken into account for the pricing decision.

- Regression pricing: A regression analysis between set price and customer orders is included into the decision making process of the manufacturer.

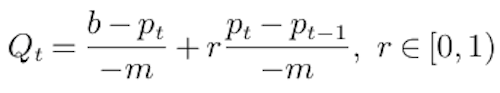

The customer’s order behavior also includes historical prices. Two demand curves are specified, a long term demand curve, where the demand is linear in price, and a short run demand curve where the price change is included as well (figure 1).

Results

The results show that the one period correction strategy results in a more volatile customer ordering process and lower revenues than both the naive and regression pricing strategies. Also in these terms the regression pricing strategy performs

worse than the naive strategy. The Reverse Bullwhip Effect is shown to occur in the disruption setting and almost always leads to reduced revenues.

Conclusion

From my point of view the study emphasizes four things:

- All strategies involve active price changes by the company. Even though the naive strategy sounds very “lazy” it still involves using the available knowledge to optimize the profits of the manufacturer, including adapting prices.

- The limited knowledge of the manufacturer is the major obstacle in the reduction of the Reverse Bullwhip Effect and improved revenues.

- As for the Bullwhip Effect itself, the effects might be even worse with longer supply chains

- An open question for me would also be how a more realistic (i.e. slower) price setting algorithm would affect the strategies.

Rong, Y., Shen, Z.-J. M., & Snyder, L V. (2011). Pricing During Disruptions: A Cause of the Reverse Bullwhip Effect SSRN

Add new comment